How to Create TIN Certificate

TIN (Taxpayer Identification Number) is a unique number required for any individual or organization’s tax-related activities. You can now easily create it online.

What You Need:

- National Identity Card (NID)

- Mobile Number

- Email Address (if applicable)

- Address and Professional Information

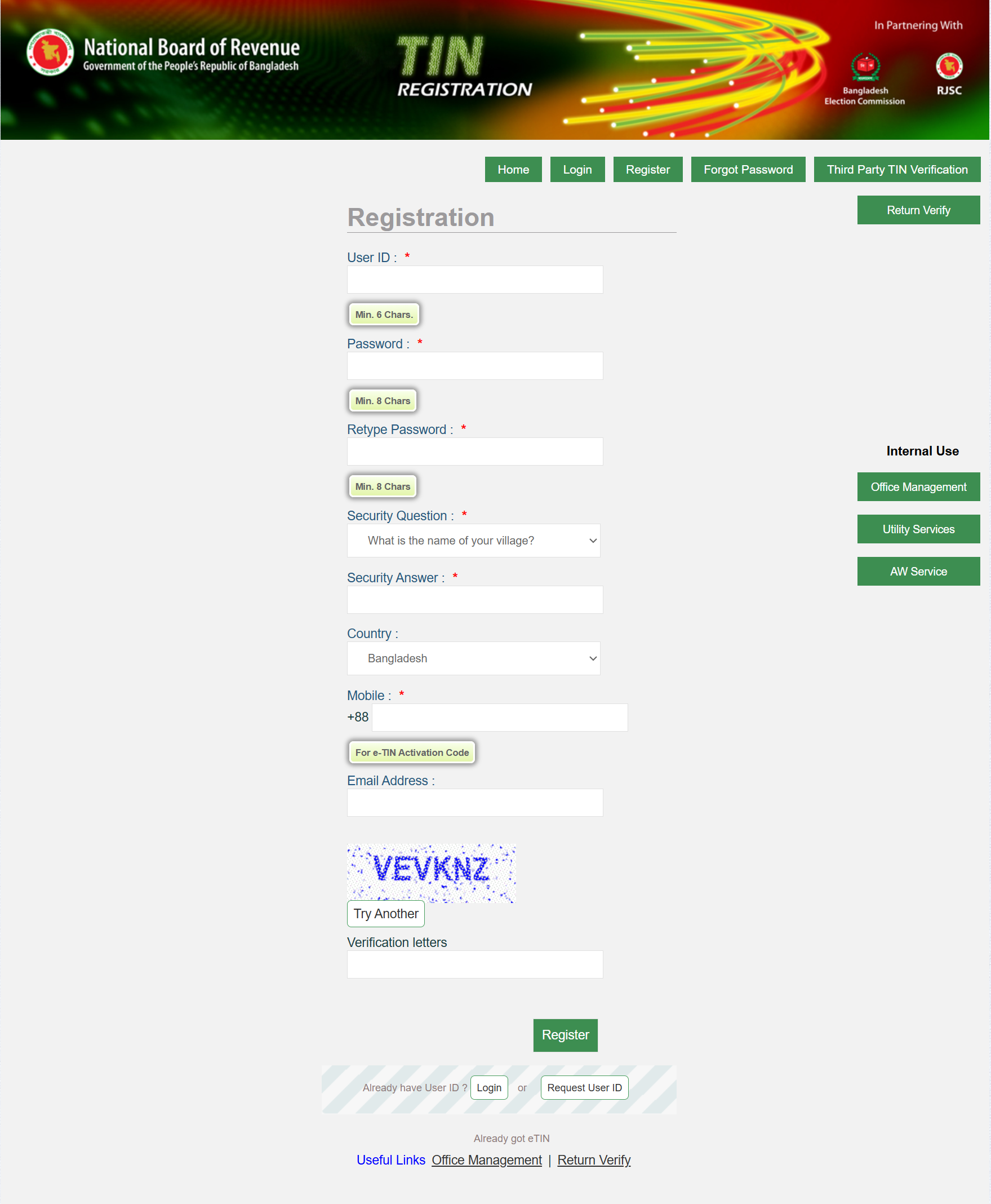

eTIN Registration Process:

Step 1: Go to the eTIN Registration Page

Step 2: You will need to create a User ID and Password.

-

- User ID: Minimum 6 characters

- Password: Minimum 8 characters

- Security Question: What is the name of your village?

Step 3: Provide your Mobile Number (+88) and Email Address.

- Mobile: Enter the mobile number with the +88 country code.

- Email Address: Provide an active email address.

Step 4: Complete the security verification by clicking on “Try Another Verification Letters.”

Step 5: After successful registration, you will receive your TIN Activation Code.

Next Steps:

- If you already have TIN, you can Login or request a new User ID.

- Once registration is successful, you can download your eTIN certificate.

Now, you can complete the eTIN registration process successfully.

See More Others Post:

How to File Your Tax Return (eReturn)

Filing your income tax return is an important responsibility for taxpayers. The eReturn system makes it easy for you to file your return online.

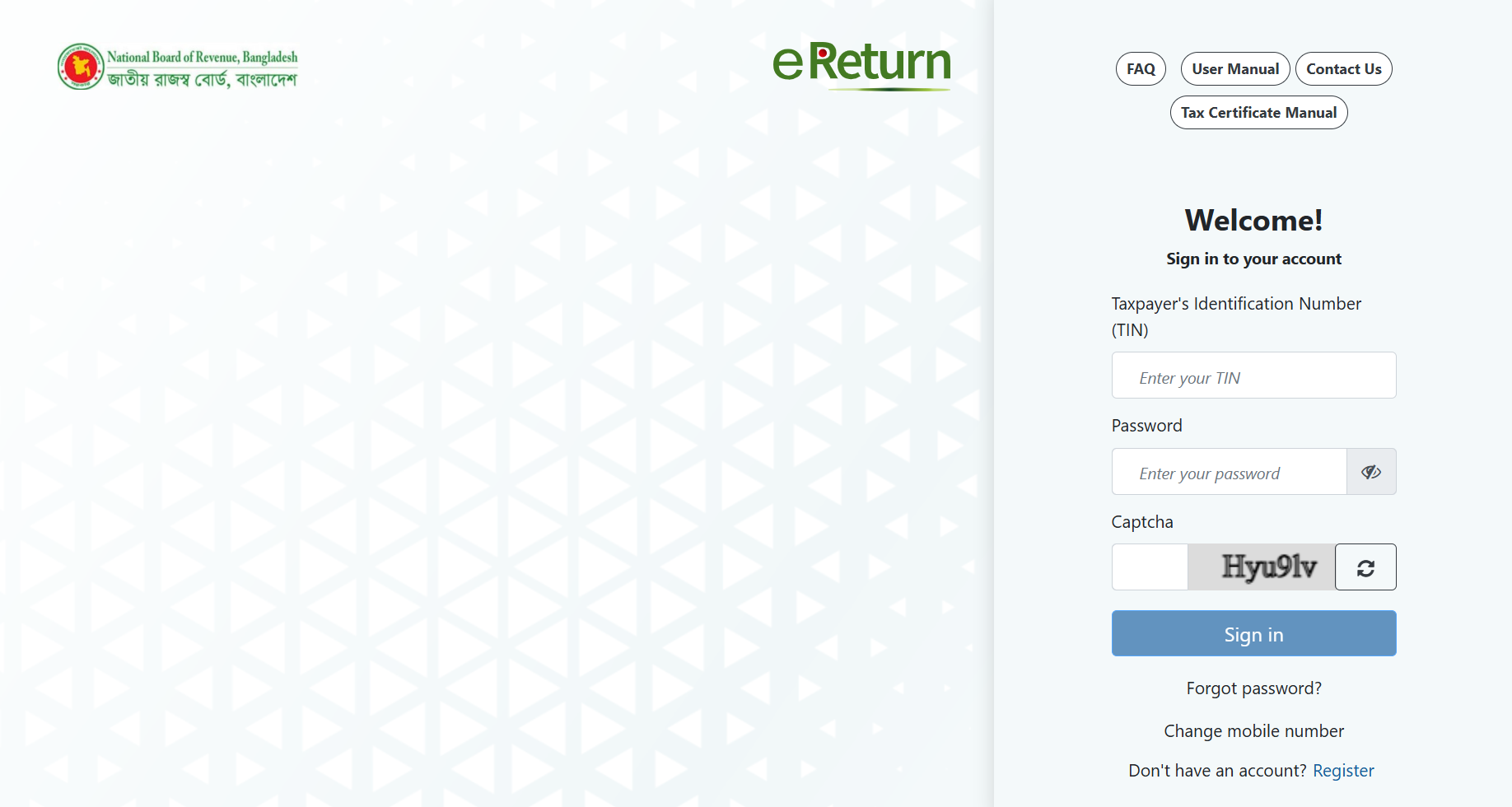

eReturn Filing Process:

-

First, go to the eReturn Sign In page and sign in with your eTIN number and password.

-

Once signed in, fill in the required details to submit your tax return.

-

After filling in all the information, submit your return and receive an Acknowledgement (PSR) to confirm that your return has been successfully filed.

New Registration Process (If You Don’t Have an Account):

-

If you don’t have an account, go to the eReturn Sign In page and click on the “Sign Up” option.

-

In the pop-up window, enter your eTIN number, mobile number, and captcha.

-

After entering the correct information, you will receive an eTIN Activation Code and your account will be created.

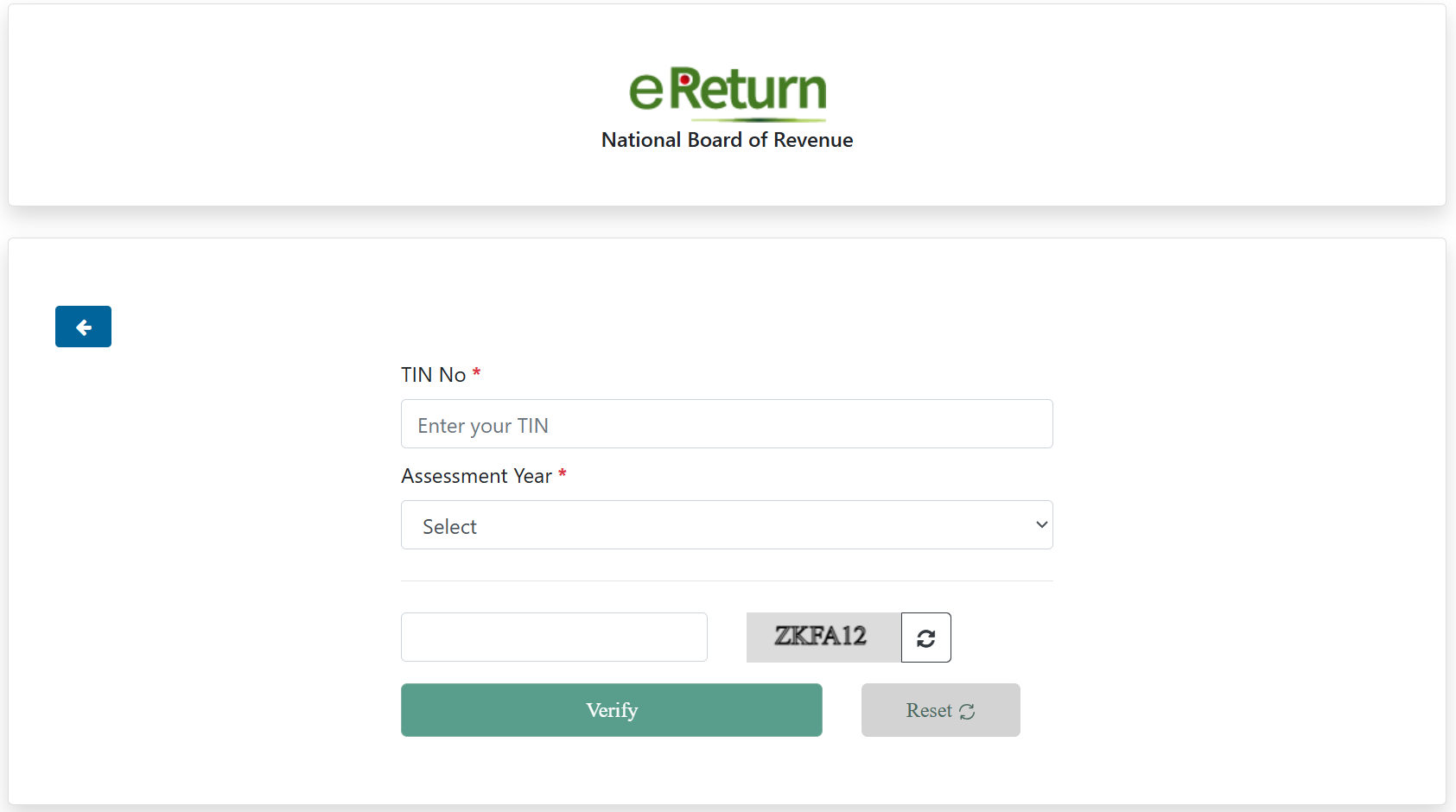

ReturnVerify/PSR – Verify Your Return and Download Certificate

After submitting your return, many users want to verify that it has been correctly submitted in the system and, if necessary, download the certificate.

How to Do It:

-

Go to the “Return Verify / PSR” option.

-

Enter your TIN number and Assessment Year.

-

If verification is successful, you can download the PSR (Preliminary Status Report).

Additionally, from “eReturnLedger”, you can check how many returns you have filed for each year.

Other Common Services and Assistance

This website offers additional important services that can help many users:

Guest User | Sign In:

If you don’t have an eReturn account, you can sign in as a Guest User and use specific services available on the platform.

eReturn Support:

If you face any issues or have questions, you can visit the eReturn Support Center to open a ticket and receive assistance.

From the Support Center, you can:

-

Open a New Ticket: Create a new support ticket.

-

Check Ticket Status: View the status of your existing ticket.

N.B: After submitting a ticket for the first time, please check your spam folder and mark the email as Not Spam.

FAQs

What is a eTIN and why do I need it?

eTIN is a unique identification number required for tax-related activities, such as filing returns and opening a bank account. It ensures you are registered with tax authorities and helps in fulfilling your tax obligations.

How can I create my TIN certificate online?

To create your TIN certificate, visit the TIN registration page, create a user ID and password, provide personal information, and complete security verification. Once registered, you’ll receive an eTIN Activation Code to finalize your registration and download the certificate.

What should I do if I forget my password?

If you forget your password, use the “Forgot Password” option to reset it by entering your registered email or mobile number and following the instructions to recover your account.

How do I file my tax return using eReturn?

Sign in with your TIN and password, fill in the required details, and submit your return. After submission, you’ll receive an Acknowledgement (PSR) confirming the successful filing of your return.

How can I verify my tax return and download the certificate?

Go to the “Return Verify / PSR” section, enter your TIN and assessment year, and if successful, download your PSR. You can also track past returns in the eReturnLedger.

What should I do if I face any issues on the website?

If you encounter issues, visit the eReturn Support Center, open a new ticket, and track its status. Remember to check your spam folder for ticket updates.

Conclusion:

The NBR digital platform is a significant help for taxpayers. Whether you are new or tired of the old manual processes, this online system is designed for you. It allows you to efficiently and quickly manage all your tax-related activities.